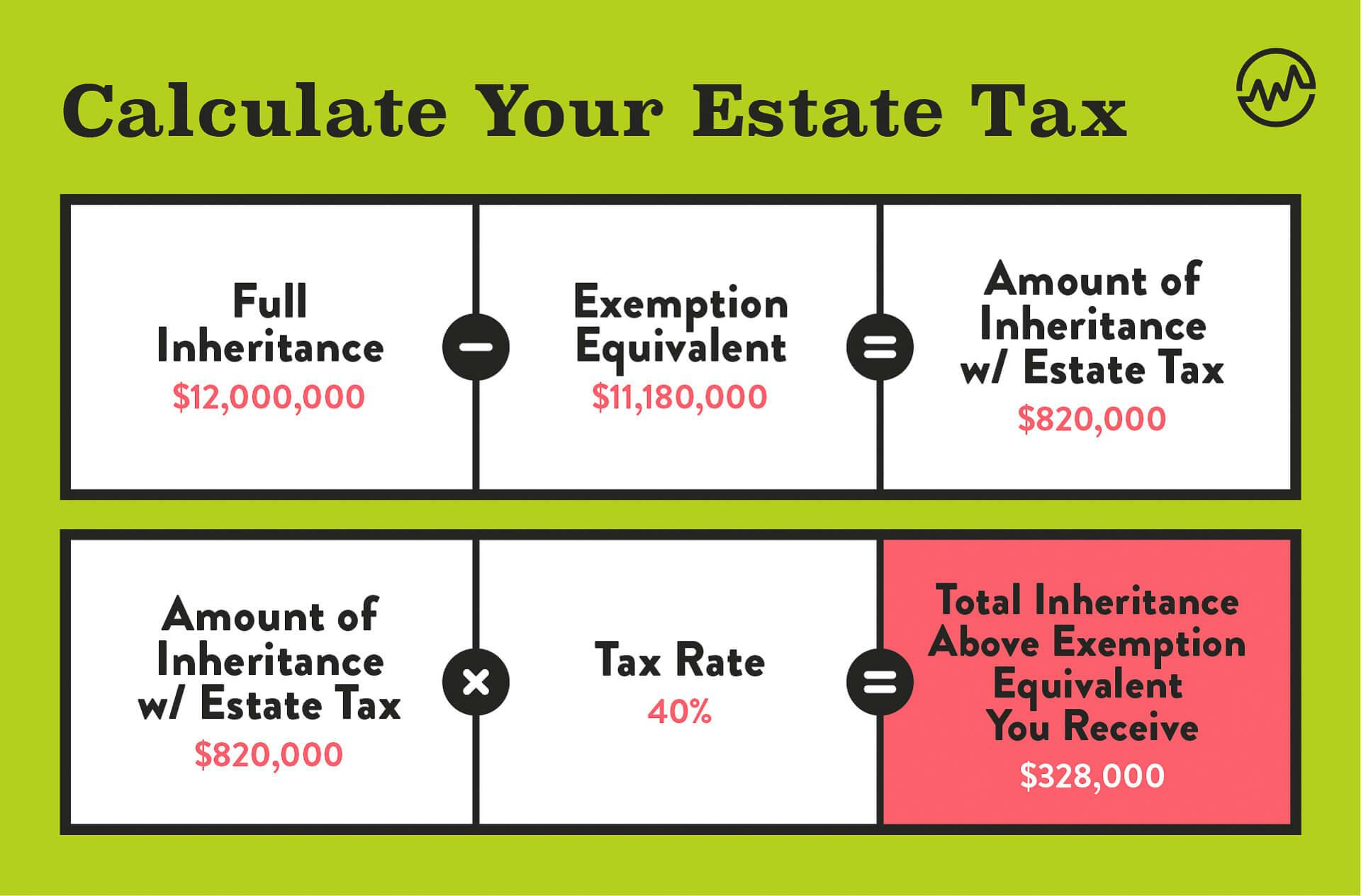

Inheritance Tax 2024 Limits. An inheritance tax is a tax beneficiaries pay when they inherit assets from someone who has died. Taper relief only applies if the.

Inheritance tax is charged at 40 per cent on. The year 2024 brings about notable changes to inheritance tax and estate planning that warrant careful consideration for effective tax planning.

Inheritance Tax 2024 Limits Images References :

Source: caseyqkristina.pages.dev

Source: caseyqkristina.pages.dev

Inheritance Tax 2024 Limits Ranee Casandra, Generally, there is no tax on the assets acquired at the time of inheritance.

Source: erinacarlota.pages.dev

Source: erinacarlota.pages.dev

Us Inheritance Tax 2024 Table Lucy Simone, In addition, gifts from certain relatives such as parents, spouse and siblings are also exempt from tax.

Source: suziqevangelin.pages.dev

Source: suziqevangelin.pages.dev

Inheritance Tax Limits 2024 Rheta Natasha, Friday 18 october 2024 at 2:14am.

Source: suziqevangelin.pages.dev

Source: suziqevangelin.pages.dev

Inheritance Tax Limits 2024 Rheta Natasha, The standard inheritance tax rate is 40% of anything in your.

Source: suziqevangelin.pages.dev

Source: suziqevangelin.pages.dev

Inheritance Tax Limits 2024 Rheta Natasha, Including the “spending envelope” that sets out limits for individual whitehall departments.

Source: suziqevangelin.pages.dev

Source: suziqevangelin.pages.dev

Inheritance Tax Limits 2024 Rheta Natasha, The good news for beneficiaries in 2024 is that the tax implications are generally favorable.

:max_bytes(150000):strip_icc()/inheritancetax.asp-final-96944c15e1cc4e17b4b94d7b88eb8cec.jpg) Source: tresabmildred.pages.dev

Source: tresabmildred.pages.dev

Inheritance Tax 2024 Carey Correna, Including the “spending envelope” that sets out limits for individual whitehall departments.

Source: clarieqkarlee.pages.dev

Source: clarieqkarlee.pages.dev

2024 Ira Contribution Limits Estimated Tax Form Ella Nikkie, It raises about £7bn a year for the.

Source: mitzibharrietta.pages.dev

Source: mitzibharrietta.pages.dev

Social Security Tax Limit 2024 Married Jointly Tally Felicity, Federal tax rates range between 18% and 40%, depending on the amount above the $12.92 million threshold, or exemption amount, per person in 2023 or $13.61 million in.

Source: maeqcarlina.pages.dev

Source: maeqcarlina.pages.dev

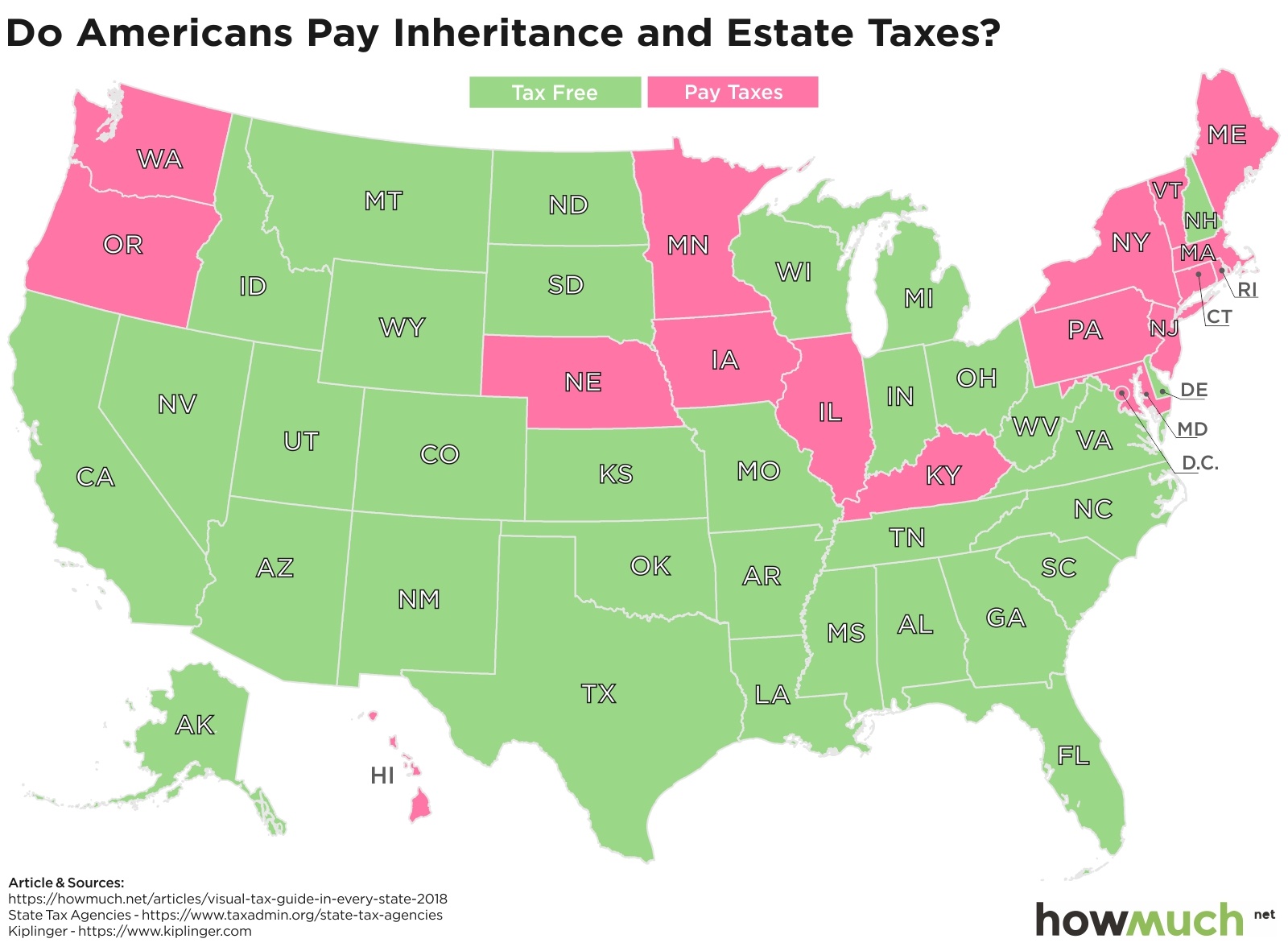

States With Inheritance Tax 2024 Kippy Merrill, The year 2024 brings about notable changes to inheritance tax and estate planning that warrant careful consideration for effective tax planning.

Category: 2024