Corporate Tax Rate Philippines 2024. This table provides an overview only. The 20% corporate income tax shall apply to corporations with net taxable income not exceeding p5,000,000 and with total assets not exceeding p100,000,000.

A lower corporate income tax of 20% is also provided for domestic corporations with. Effective 1 july 2020, the corporate income tax (cit) rate is reduced from 30% to:

Corporate Tax Rate Philippines 2024 Images References :

Source: edyqaurelea.pages.dev

Source: edyqaurelea.pages.dev

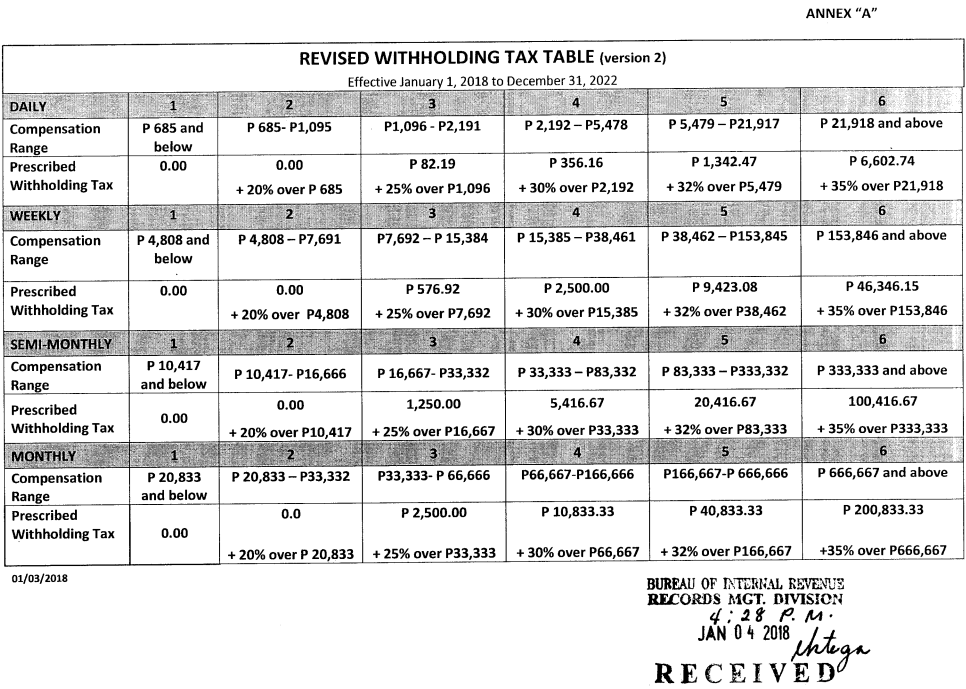

Withholding Tax Calculator Philippines 2024 Binni Doretta, Effective 1 july 2020, the corporate income tax (cit) rate is reduced from 30% to:

Source: alanamignonne.pages.dev

Source: alanamignonne.pages.dev

Tax Calculator 2024 Philippines Bir Ileana Fanchette, The headline cit rate is generally the highest statutory cit rate, inclusive of surtaxes but exclusive of local taxes.

Source: raniprisca.pages.dev

Source: raniprisca.pages.dev

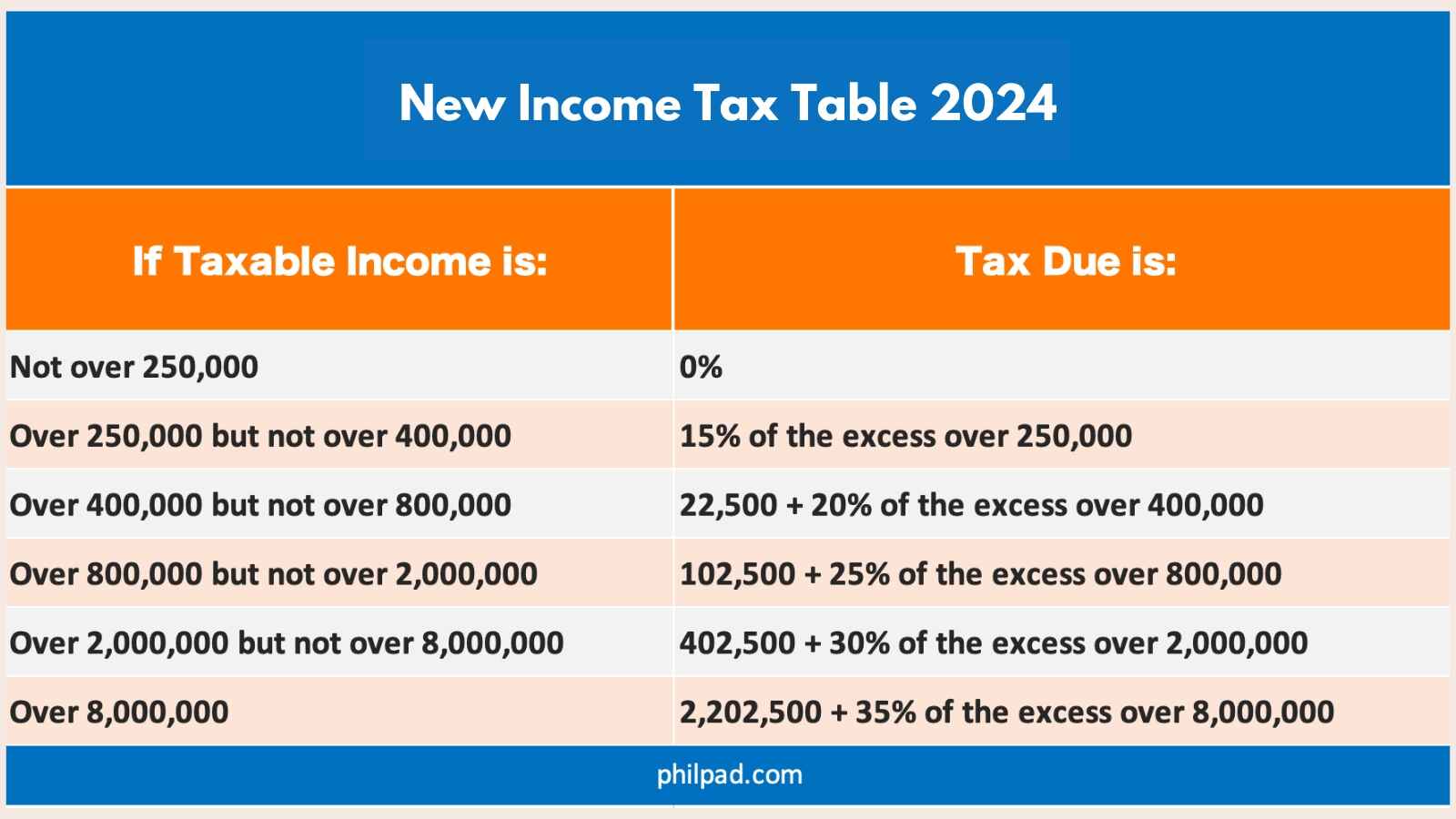

Philippine Corporate Tax Rate 2024 Alli Luella, The corporate income tax rate is 25% while the minimum corporate income tax (mcit) is 2%.

Source: guifanchette.pages.dev

Source: guifanchette.pages.dev

Tax Brackets 2024 Philippines Rois Vivien, This table provides an overview only.

Source: jacquiqnikolia.pages.dev

Source: jacquiqnikolia.pages.dev

Tax Table 2024 Philippines Anny Tressa, Subject only to the regular income.

Source: perriqodetta.pages.dev

Source: perriqodetta.pages.dev

Corporate Tax Rate Philippines 2024 Gert Nikaniki, Real property located in a province may be subject.

Source: xylinawkatya.pages.dev

Source: xylinawkatya.pages.dev

2024 Tax Table Philippines Crysta Emmalee, One of the significant reforms under the create act is the lowering of the corporate income tax rate from 30%, previously the highest in asean region, to 20%.

Source: philippines.acclime.com

Source: philippines.acclime.com

Corporate Tax in Philippines Rates & Incentives Acclime, The corporate income tax rate shall be applied on the amount computed by multiplying the number of months covered by the new rate within the fiscal year by the taxable income.

Source: printableformsfree.com

Source: printableformsfree.com

Tax Rate Ph 2023 Printable Forms Free Online, This table provides an overview only.

Source: imagetou.com

Source: imagetou.com

Corporate Tax Rates For 2024 Image to u, 20% for domestic corporations with net taxable income not exceeding php5 million.

2024